| Product | Gross Fee paid by lender | Net fee paid to regulated broker | Net Fee paid to non-regulated & client referral service |

|---|---|---|---|

| All Products | 0.85% | 0.45% | 0.22% |

| Semi Commercial | 1.20% | 0.60% | 0.30% |

Foundation – the home of specialist mortgages

- Residential mortgages for borrowers with complex income, employment or credit history

- Buy-to-let mortgages for landlords, portfolios and limited companies

- Specialist property types including HMOs and multi-unit blocks

Not every case is straightforward, or ordinary. Some clients have circumstances that are a bit more, well, extraordinary.

That is where we can help. Whether it is a client who has recently changed jobs, is self-employed, has income from unusual sources, or some blips on their credit record, we can help.

There is a wide choice of products and flexible criteria to suit a range of extraordinary circumstances.

- Self-employed – directors, partners and contractors; retained profits considered

- Employed – no minimum term in current job (minimum 3 months employed)

- Clients with multiple and unusual income sources

- Holders of credit blips / lower credit scores

- Eligible Professionals looking for up to 6 x income

- Maximum loan £2m

- Maximum term 40 years

- Maximum age 75 at end of term

- No minimum income

- Maximum number of applicants is 4 (immediate family)

- Capital and repayment mortgages – see website for LTV limits

- Interest only, affordability calculated on an interest only basis up to 70% LTV

- Capital raising for buy to let purchase accepted

- Part and part mortgages – see website for LTV limits

- Green mortgages for properties with EPC rating A-C, in both the buy to let and residential ranges

- Individual or limited company

- Limited companies with complex structures

- Up to 4 directors

- Newly incorporated limited companies acceptable

- No minimum term of employment/self-employment and no minimum income

- First time landlords considered

- Ex-pats considered as individuals or limited companies

- Loans up to £2m on core range

- ICR of 125% for limited company borrowers and basic rate taxpayers and 145% for others

- No limit to portfolio size, subject to maximum borrowing of £5m with Foundation

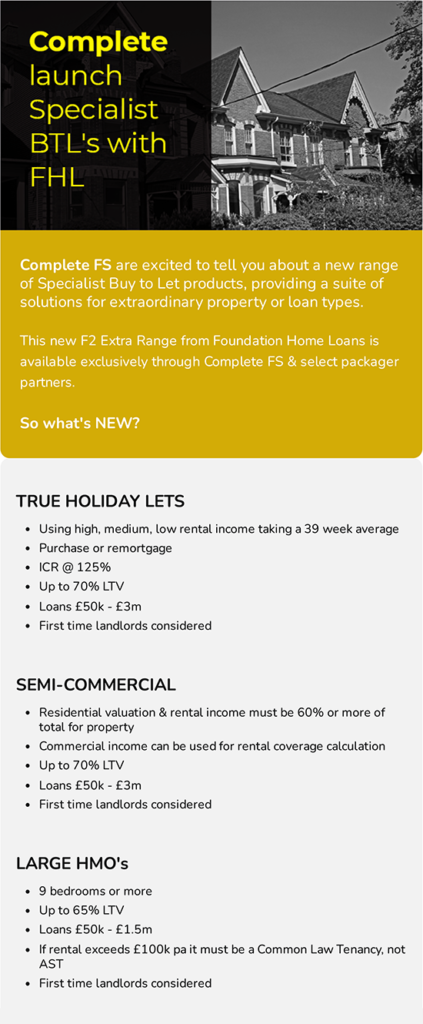

- Specialist properties such as HMOs, short term lets and Multi Unit Blocks

- HMOs: up to 8 bedrooms and MUBs: up to 10 units

- Green Mortgages available for purchase and remortgage

Foundation Home Loans is the home of specialist buy to let and residential mortgage lending. With over 300 members of staff, and dedicated regional account managers and internal business development managers, we offer support to you throughout all the stages of your clients’ application.

Intermediaries tell us they like our easy-to-use portal and flexible underwriting. It’s our aim to be the most trusted lender in the specialist sector so contact us for support throughout our underwriting process.

New Enquiry/Case Tracking

For all your online enquiries, DIP’s, applications and case updates you can use BORIS.

Complete Introducer Service

Want to introducer to us? We have fully qualified mortgage advisers who will take on the advice part for you.